Success Team

The following is from chapter three of our award-winning book, The Exit Strategy Handbook.

Chapter 3

The Success Team™

Your first step should be to assemble an outstanding professional team to advise you. Most business people select their professional team on the eve of their sale. This is far too late in the sale process. By selecting your professional team several years before the target date for your sale, you can obtain their guidance in the presale years as to methods of minimizing the obstacles.

Frederick D. Lipman 18

On the next page are the team members we recommend for The Success Team™ and a brief description of their roles during this process.

Business Owner

Role – Direction and final decisions

Goal – Increase sales and company value

B2B CFO®

Role – Team Manager

Goal – Coordinate the Team, assist with process

M&A Company or Investment Banker

Role – Advice about potential buyers

Goal – Find the best buyer

Attorney

Role – Legal

Goal – Legal documentation and advice

Tax Specialists

Role – Tax planning

Goal – Tax planning

Auditors

Role – Auditing

Goal – Examine Financial Statements

IT Specialists

Role – Software and hardware

Goal – Documentation and advice

Wealth Manager

Role – Money management advice

Goal – Pre-sale advice and post-sale wealth management

Appraiser

Role – Appraise the company

Goal – The business value and the primary methods of valuation

Insurance Advisor

Role – Insurance advice

Goal – Advice on current and future risks

Banker

Role – Lending advice

Goal – Assist with lending activities

Key Employees

Role – Support

Goal – Information and transition

Directors, Executive Coaching Organizations, etc.

Role – Advisory

Goal – Advice and consultation

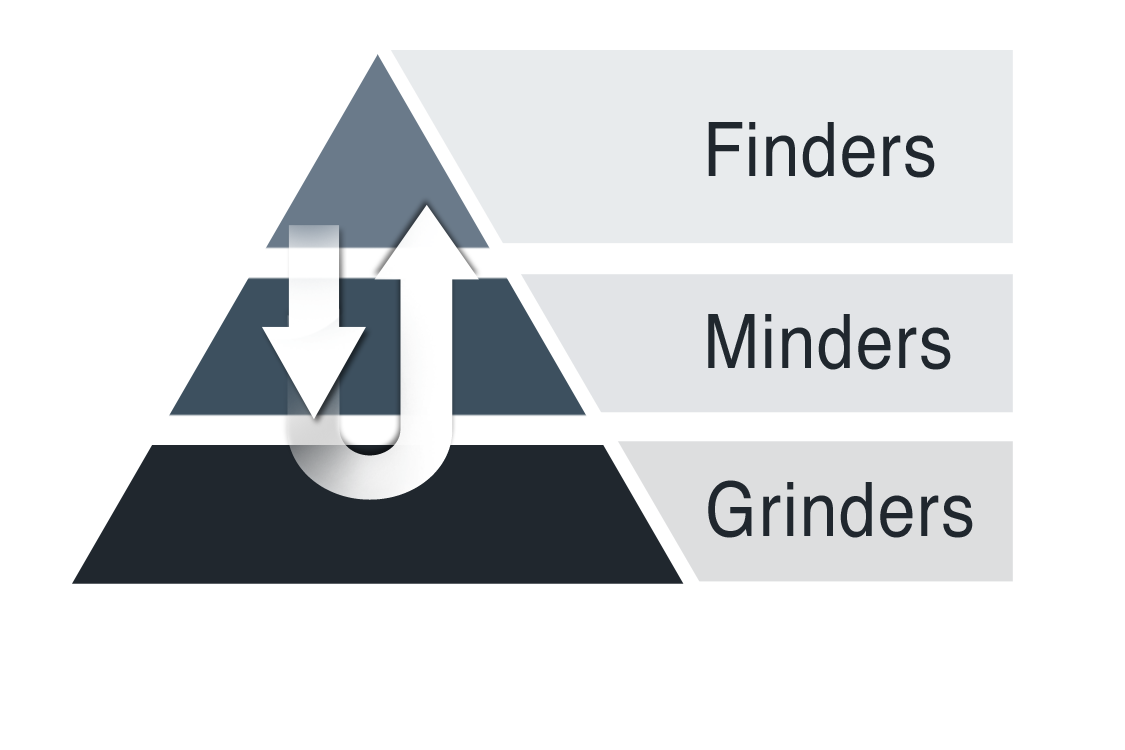

Business Owners

(Finder)

The business owner is usually the Finder in the business. This is the most important role on The Success Team™ during the exit strategy process. The business owner is the Finder and the principal roles in the company are to be:

The entrepreneur, the visionary, the leader, the idea generator and the catalyst for future change. Finders work in the future. 19

This is your business. You are in charge. Your most effective role on The Success Team™ is to:

-

- Select outstanding professionals.

- Delegate key tasks to these team members.

- Use our process to track their progress.

- Spend most of your time in Finding activities.

Many business owners get distracted during the exit strategy process and find themselves involved in performing administrative tasks (Minding). This is a serious mistake. The business owner should continue to increase the value of the business. This is typically done by continued focus on those things that increase the future value of the business. Those activities are typically increasing sales, finding new customers, building better relationships with current customers, etc.

Business Owners Increased Value Through EBTIDA

We will spend time on topics such as earnings before interest, taxes, depreciation and amortization (EBITDA) later in this book (The Exit Strategy Handbook), which can be a key method to determining the value of your business. An author has stated the following about increasing EBITDA during the exit strategy process:

For each $1 that you increase your EBITDA during the valuation year, you should arguably receive an additional $4 to $6 in sale price.

Frederick H. Lipman 20

Mr. Lipman is suggesting that for each $1 million you increase EBITDA during the exit strategy process, you should see an additional $4 million to $6 million in sales price!

We propose that there is nobody on The Success Team™ who has your talent and drive to increase the future sales price to this degree. We recommend you delegate important tasks to others in The Success Team™ and keep your focus on increasing the value of the company. That is, after all, the best use of your talents.

Team Manager

Most exit strategy experts recommend hiring an outside person to lead The Success Team™.

Retain a point person. Even with an inside sale, I believe a third party point person is essential.

Rick Rickertsen 21

There is no requirement that the Team Manager be an outside person. There are, however, some advantages to hiring an outside nonemployee as the Team Manager. This person:

-

- Has experience in the exit strategy process

- Is not worried about losing a W-2 job when the transaction closes

- Is focused solely on completing the exit strategy process

- Will help the other team members keep focused on their deadlines

- Can easily communicate important concerns and issues directly to you

- Allows you to spend less time delegating and following up on matters

- Will give you more time to focus on increasing the value of the business

We recommend the Team Manager use this book and the accompanying dashboard software to help manage The Success Team™.

M&A Company or Investment Banker

The role of this team member is to find the right buyer for your business. As one author states:

They act as sage counsel, uncover a large universe of buyers, run your auction, take on the role of the bad guy so the business owner doesn’t have to. They run great interference and know how to play buyers off against one another to get you the

absolute best deal. And they normally can smoke out when a buyer is not real, which can save you huge amounts of time and money. Remember, their fees are nearly all success-based. They only get real money if you get real money. 22

These companies will ask you to sign a lengthy and binding contract. They will want exclusivity from their competition. This means you must carefully consider hiring the right company. The attorney on The Success Team™ should be involved in this process and should review all documents prior to signing.

Attorney

The attorney hired to be on The Success Team™ should be experienced in exit strategy sales transactions. There will be many documents and much advice needed from this professional.

One of the key documents this attorney will create or review for you is the confidentiality and nondisclosure documents to be signed by the potential buyer. It is paramount that you not divulge trade secrets, key information about customers and other critical information until the attorney and other team members feel you have as much protection as possible in dealing with potential buyers.

In short, no document should be signed in the exit strategy process without the review, input and advice from the attorney on The Success Team™.

Tax Specialists

Tax specialists are tax attorneys and Certified Public Accountants (CPAs) who are specialists in taxes in the following areas:

-

- Federal income taxes

- State income taxes

- Foreign taxes

- Personal property taxes

- Real estate taxes

- Sales and use taxes

- Payroll and withholding taxes

- Estate taxes

- Etc.

The role of the tax expert is more than simply calculating the net cash available to you after the sales transaction. This professional’s role is also to look for and advise you regarding any unrecorded or potential taxes that may possibly be a surprise to you prior or subsequent to the sale.

Taxation is usually a very frustrating part of the exit strategy process. Many business owners assume they will receive capital gains treatment on the sales proceeds. They frequently are surprised to know that there are often material items in the transaction that receive ordinary income treatment, such as the recapture of accumulated depreciation.

No purchase offer should be seriously considered until the tax specialists of The Success Team™ have had adequate time to thoroughly calculate and educate all members of the team on all potential tax issues that might occur prior or subsequent to the sales transaction.

Auditors

The buyer may require an examination by an independent CPA firm for two or three years prior to the sale. The buyer will rely on the examinations performed by the independent CPA firm to determine if the financial statements of your company have integrity.

The lack of financial integrity is one of the most common hurdles encountered during the sale process. In addition, the best way to demonstrate the sustainability of your company’s earnings is to have its historical financial statements audited by an independent, certified public accounting firm. An audit demonstrates to the potential buyers that the historical information can be relied upon when making judgments about buying the company based on historical cash flows. It is very important to have your CPA review your current financial statements and practices so that any financial irregularities or inadequacies are immediately exposed and corrected.

John H. Brown 23

One of the most difficult decisions you and The Success Team™ will have to make is whether you should hire your own auditors or allow the buyer to hire their own auditors. There are pros and cons to each of these decisions, which will be discussed in a subsequent chapter of this book.

IT Specialists

The IT specialist is a very important member of The Success Team™. This professional will advise the other team members regarding certain important information about the company, such as:

-

- Licensed or unlicensed software used by the company

- Software owned by the company

- URLs and websites owned by the company

- Restrictions of transfers or changes in control of software

- Ownership and location of important hardware

- Ownership, location and control of cloud-based software

- Passwords and usernames of all software used

- Etc.

The Success Team™ should work together to hire the best person or company possible to provide this function in the exit strategy process.

Wealth Manager

Many business owners wait until the transaction closes before they talk to their wealth manager about their options to invest the net cash from the sales transaction. This delay in talking to the wealth manager could possibly be the largest mistake you could make during the exit strategy process.

(Baby) Boomers need a lot of money when we leave our companies because we will live longer than our parents did and we want to be active. Living longer and more actively means we need more money than we may have originally thought. What this means to you is that you’ll likely have decades to live after you leave your company. The challenge is to create a nest egg big enough to (1) cover the expensive medical care, including even more life extending and quality of life treatments, (and if not that, the expensive health insurance premiums) we’ll want and need as we age; and (2) last until we die. We Boomers have a lot of living left to do and we want to live well.24

Wealth managers should be brought into The Success Team™ early in the process. These professionals need to work with the tax specialists and others on the team. They will need to know the estimated value of the assets that will be available after taxes to provide for your financial future. It is also important for them to hear if the auditors feel significant adjustments will be made that might impact the value of the sale. Additionally, they need to work with the M&A firm/Investment Bankers to understand what type of buyer will eventually purchase your company.

Wealth managers also need to know if the purchase price will be all cash or if there will be a note payable. Most importantly, these professionals need time with you to find out what your post-sale goals and needs will be in order to ensure that you will be able to accomplish those goals and needs from a financial perspective. Wealth managers will be very focused on your quality of life once the sale of your company has been completed. They will work with you and your future generations to preserve and grow the liquidity that is created by the sale both now and in the foreseeable future.

Appraiser

Your company will want to receive a preliminary appraisal prior to bringing in a potential buyer. The Success Team™ will help advise you on the timing of this appraisal.

You can look at this process as similar to that of selling a home. Let’s say you want to sell your home for a certain sales price. It makes sense to receive a preliminary appraisal before spending too much money on fixing up the home and putting it on the market.

An appraisal of your business, which specifies the primary valuation methods and factors, should be sought from a qualified appraiser well in advance of the expected sale date. Such an appraisal could cost as little as $5,000 to $10,000. Select the appraiser by reputation and personal recommendation. What is important is not so much an appraisal of what your business is currently worth but rather an understanding of the primary methods of valuation and valuation factors. 25

The timing of this appraisal should be decided by The Success Team™. The entire team could then use the assumptions and information used in the appraisal to determine a strategy to be used for the exit strategy process.

Insurance Advisor

The insurance advisor’s role in the exit strategy process is to help The Success Team™ with certain documentation and planning.

The documentation will relate to the location and termination dates of certain important insurance policies, such as property and casualty, general liability, automobile, errors and omissions, directors and officers, key man life, disability, health, business interruption, bonds, umbrella, workers compensation, etc. It is important for the insurance advisor to advise The Success Team™ so that these and other important policies remain in effect during the exit strategy process and through the close of the sale transaction. The insurance advisor may recommend that some insurance policies remain in place after the close of the sale transaction.

An important role of the insurance advisor is to assist The Success Team™ in preparing for the unexpected events. The age-old adage applies with this professional, “Hope for the best and prepare for the worst.” Numerous unplanned events may take place during the exit strategy process, and it is wise to be as prepared as possible for them:

-

- The untimely death of the business owner

- The untimely death of a minority business owner

- Unexpected claims on insurance policies

- Significant changes in insurance policies by insurance carriers

- Untimely termination of insurance policies by insurance carriers

- Accidents that are not adequately covered by existing insurance policies

- Etc.

The insurance advisor should be aware of the plans and activities of The Success Team™ to help them achieve their exit strategy goals.

Banker

Bankers are seasoned business advisors. Many have seen their customers go through an exit strategy.

Nobody can predict the date when your company will be sold. The process may take a few months or a few years. Your company needs to continue its operations on a day-to-day basis, and bankers are an integral part of helping the company with its operational lending needs.

One of the key principles in this book (The Exit Strategy Handbook) is the concept of increasing sales to increase company value prior to the sale. Bankers understand that increases in sales often negatively affect the cash flow of the company. They realize that increased sales will cause increases in accounts receivable, inventory, fixed assets, overhead, etc., which often cause a decrease in cash. Bankers should assist your company through this process to help with increases in lending of lines of credit and other loan instruments.

It is easier for bankers to know your company’s lending and banking needs if they are a part of The Success Team™. This gives them the opportunity to understand the needs of the company and to possibly act quicker on creating loan instruments.

The business advice of these experienced veterans is often very valuable, and their input should be asked throughout the exit strategy process.

Bankers can also help fund some of the purchase. Your banker should be considered as a possible resource to assist with the funding of the transaction with the buyer.

Key Employees

Key employees can make or break the sale of your business. Some of them will become an important part of the process of assisting The Success Team™ and the transition subsequent to the close of the sale. These employees will eventually hear about your desire to sell your business. Some of their immediate concerns might be:

-

- The possible loss of their job and benefits

- Not working in the future with you

- Possible changes in the culture of the company

- The stress of working for another company, different management, etc.

- Changes in salary or benefits

- Job insecurity

The Success Team™ needs to advise you about how to deal with key employees before they are told about your desire to sell the business. One author provides the following advice:

Don’t issue stock options to retain key employees after an acquisition. Instead, use a simple stay bonus that offers the member of your management team a cash reward if you sell your company. Pay the reward in two or more installments only to those who stay so that you ensure your key staff stays on through the transition.

John Warrillow 26

The Success Team™ might consider advising you on matters such as the following:

-

- Cash bonuses

- The signing of confidentiality agreements

- The signing of long-term employment agreements

- Training of key employees about disclosures to other employees, vendors, customers, etc.