Broker-Dealer

B2B EXIT® recommends that our clients work exclusively with FINRA licensed, bonded and regulated broker-dealers to assist with the sale of their companies. Their main role on the Success Team is to find qualified buyers. We expect sage advice from these broker-dealers as our clients go through the process.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

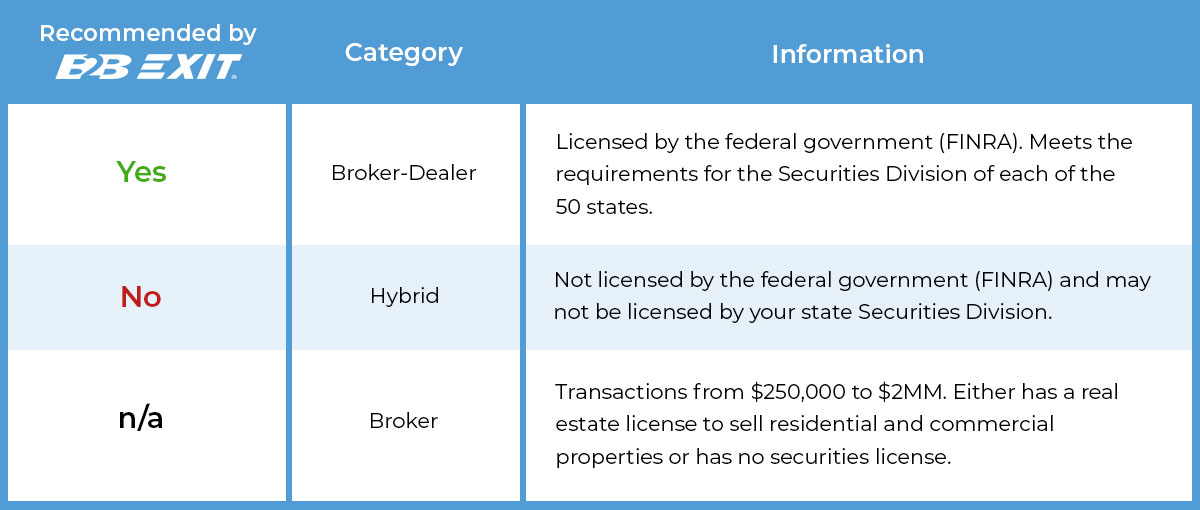

B2B EXIT® is often a referral source for broker-dealers. We are frequently used in the interview process. For clarification, we do not recommend Hybrids, which are companies that promote themselves as M&A firms but are not licensed by the federal government. Worst, they may not be licensed by the individual state Securities Division, which often have regulatory requirements that are stricter than the federal government. (While the SEC regulates and enforces the federal securities laws, each state has its own securities regulator who enforces what are known as “blue sky” laws.) Caveat Emptor!

Hiring the professionals to help sell or acquire a business can be confusing due to the numerous titles they use on their websites and advertisements. Some of the titles used are correct but some are misleading, such as; Investment Banker, M&A Company, M&A Advisors, M&A Firm, etc. This page has information that is critical for business owners in their hiring process.

Payment of Referral Fees (Kickbacks)

Broker-dealers (B-D) are prohibited from paying referral fees on the sale of securities. B2B EXIT® supports this practice as it eliminates questions of ethics and honesty on behalf of the person referring a B-D to one of our clients. (https://www.finra.org/rules-guidance/rulebooks/finra-rules/2040)

Hybrids often pay kickback fees for referrals. The arrangements to pay kickback fees are oral contracts. The kickback percentage is often 10%+ on (a) the amount the business owner pays the Hybrid at the time of the signing of the contract ($40,000 to $100,000) and (b) upon the close of the transaction.

We recommend business owners ask themselves the following questions if any person/company recommends a Hybrid:

1. Why is this person recommending a Hybrid instead of a broker-dealer?

2. Did the person making the referral obtain your permission to receive the kickback before you signed the contract with the Hybrid?

3. Is the person making the recommendation working for you or for the Hybrid?

4. What is the amount of the kickback the Hybrid will pay the referring person?

5. Can you trust the future advice of someone who will earn a Hybrid kickback?

Research on Broker-Dealers (B-D) – Have your attorney do the following:

1. Obtain a BrokerCheck Report – This detailed FINRA report will give information regarding the ownership, licensing, complaints, etc. from (https://brokercheck.finra.org/).

2. Browse the list of brokers barred by FINRA (https://www.finra.org/rules-guidance/oversight-Oversight%20%26%20Enforcement/individuals-barred-finra).

3. Check out the SEC Action Lookup tool (https://www.sec.gov/litigations/sec-action-look-up) for formal actions that the SEC has brought against individuals, including those who are not brokers.

Research on Hybrids – Have your attorney do the following:

1. Run the FINRA BrokerCheck Report for any Hybrid that proclaims to be an Investment Banker or broker-dealer.

2. Go to your state securities regulator (https://www.nasaa.org/contact-your-regulator/) to do additional research on brokers and investment advisors. (Again, broker-dealers are prohibited to pay referral fees for the sale of securities.)

3. Determine if your state securities regulator allows kickback payments from the Hybrid to the person who gave the referral.

Search – Hire a very talented person/company to do an internal search on the company you are considering to hire. Ask for information on public complaints, civil litigation, criminal matters or misdemeanors that are investment-related or involve theft or a “breach of trust.”

Contact Us

Get the professional advice and guidance you need from our experienced advisors.

[gravityform id="1" title="true"]